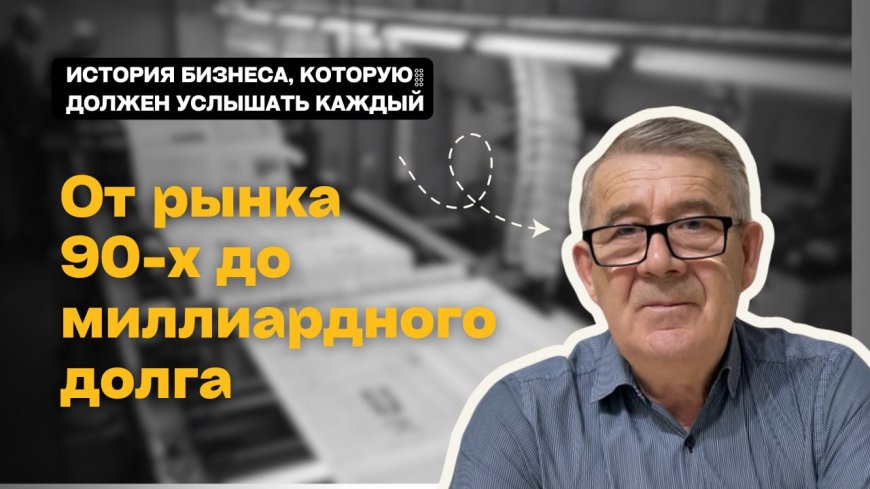

Debt Trap: How an Entrepreneur Ended Up Owing 1.8 Billion Tenge

The story of Yuriy Vladimirovich is a journey from business success to financial ruin and a long battle with banks. Starting with a small business in the 90s, he faced a devastating fire, mounting debts, lawsuits, and unjustified penalties, which ultimately led to a 1.8 billion tenge debt.

How It Started

— In the 1990s, Yuriy Vladimirovich launched a printing business, purchasing equipment with his own funds.

— In 2006, his company took out a loan from ATF Bank to buy new equipment.

— In 2007, a fire destroyed equipment and products worth 160 million tenge.

The company managed to recover, but lost its working capital, leading to financial difficulties.

Bank’s Refusal to Help and Growing Debt

— In 2012, Yuriy Vladimirovich suffered a heart attack and underwent surgery.

— In 2014, the company attempted to refinance the debt, but the bank capitalized the liabilities, increasing them to 268 million tenge.

— The global crisis and digitalization severely impacted the printing industry, leading to declining revenues.

— In 2015, the entrepreneur requested the bank to declare a default or take legal action, but received no response.

By 2020, the bank merged with another financial institution, and Yuriy Vladimirovich’s debt was transferred to the Problem Loan Fund.

Problem Loan Fund and Escalating Debt

— In 2020, the Problem Loan Fund purchased the debt for 258 million tenge.

— However, the Fund later demanded 1.2 billion tenge.

— In 2024, the Fund filed a lawsuit for 2.8 billion tenge, adding penalties and fines dating back to 2015.

Yuriy Vladimirovich does not understand how such a sum was calculated and is trying to challenge the claim.

Legal Battle

— In court, the borrower stated he could not pay the debt.

— The court proposed mediation, but the Fund did not respond.

— The court ruled that he must pay 1.8 billion tenge.

The borrower filed an appeal, and the regional court proposed a mediation settlement, but it has yet to be finalized.

Conclusion and Petition to the Government

Yuriy Vladimirovich urges entrepreneurs to carefully assess risks before taking out loans. He plans to submit a petition to the government, calling for protection of businesses from arbitrary charges by banks and financial institutions.

Do you have news that could become a sensation?

Or do you want to try yourself as an editor?

On altn.news , it's possible!

Share your materials, express your opinion, and test your skills as a journalist or editor.

It’s simple:

✅ Download the app:

✅ Register on the website.

✅ Create and publish your news.

Who knows, maybe your material will become the next big headline!

Start today on altn.news.

The editorial board is not responsible for the content and accuracy of material taken, sent or obtained from other sources. The publication of such materials is for informational purposes only and does not imply automatic endorsement or approval of their content.